Unlock Financial Flexibility: Your Comprehensive Guide to Credit Repair

Unlock Financial Flexibility: Your Comprehensive Guide to Credit Repair

Blog Article

A Comprehensive Guide to Exactly How Credit Scores Fixing Can Change Your Credit Report

Recognizing the complexities of credit report repair is vital for anybody looking for to enhance their financial standing - Credit Repair. By dealing with issues such as payment background and debt use, individuals can take aggressive actions toward boosting their credit report scores. However, the procedure is typically stuffed with false impressions and potential mistakes that can impede development. This overview will certainly light up the key strategies and considerations needed for effective debt fixing, ultimately revealing how these initiatives can cause a lot more positive economic possibilities. What stays to be explored are the particular actions that can establish one on the path to a much more durable debt profile.

Understanding Credit History

Understanding debt ratings is crucial for anyone seeking to boost their financial health and gain access to better loaning choices. A credit history is a mathematical representation of a person's credit reliability, usually ranging from 300 to 850. This rating is created based on the details included in a person's credit rating report, which includes their credit background, exceptional financial obligations, payment history, and kinds of credit report accounts.

Lenders utilize credit history to evaluate the danger related to lending cash or prolonging credit history. Greater scores show lower threat, frequently causing extra desirable lending terms, such as reduced passion prices and higher debt limitations. On the other hand, reduced credit scores can cause higher rates of interest or rejection of credit report completely.

Numerous aspects influence debt scores, including payment history, which accounts for around 35% of the score, adhered to by credit use (30%), length of credit rating background (15%), kinds of credit rating in operation (10%), and new credit scores inquiries (10%) Understanding these elements can empower people to take workable steps to boost their scores, inevitably boosting their economic opportunities and stability. Credit Repair.

Usual Credit Score Issues

Numerous individuals encounter typical credit history concerns that can hinder their economic development and impact their credit report ratings. One widespread issue is late payments, which can considerably damage credit scores rankings. Even a single late payment can remain on a credit scores record for a number of years, impacting future loaning potential.

Identity theft is an additional significant issue, possibly causing deceptive accounts showing up on one's credit rating report. Such scenarios can be testing to remedy and might call for substantial effort to clear one's name. In addition, errors in credit score reports, whether because of clerical mistakes or out-of-date details, can misrepresent a person's creditworthiness. Attending to these common credit history concerns is essential to boosting economic health and wellness and establishing a solid credit rating profile.

The Credit Scores Repair Refine

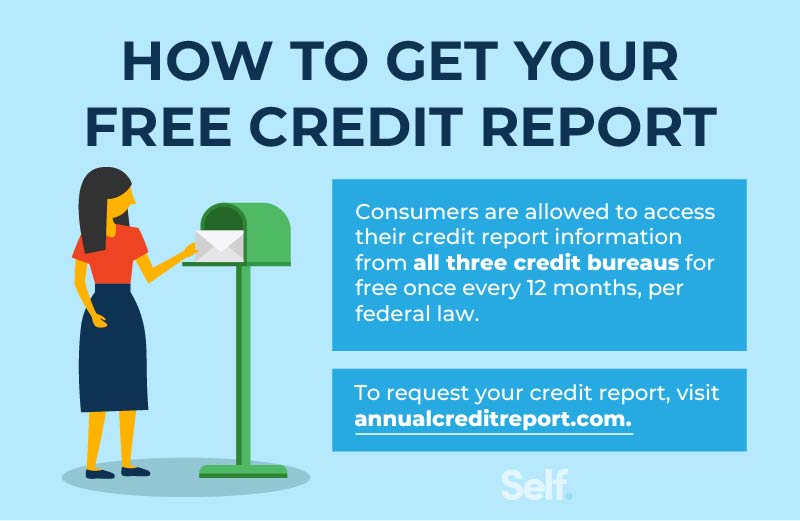

Although credit repair service can seem complicated, it is a systematic procedure that people can embark on to boost their credit history and correct mistakes on their credit history records. The very first step includes getting a copy of your credit rating report from the three major debt bureaus: Experian, TransUnion, and Equifax. Evaluation these reports thoroughly for discrepancies or mistakes, such as incorrect account details or out-of-date info.

As soon as mistakes are determined, the next action is to contest these errors. This can be done by calling the credit bureaus directly, giving documents that supports your claim. The bureaus are called for to check out disagreements within thirty day.

Preserving a consistent settlement background and managing credit report usage is also vital during this procedure. Monitoring your credit score regularly makes certain ongoing click here for info accuracy and assists track improvements over time, reinforcing the effectiveness of your credit report repair service initiatives. Credit Repair.

Advantages of Debt Repair Service

The advantages of debt repair work expand much beyond simply increasing one's credit history; they can considerably influence financial stability and chances. By dealing with mistakes and negative things on a credit rating report, individuals can improve their credit reliability, making them extra appealing to lending institutions and monetary organizations. This improvement usually results in better rates of interest on try this finances, lower costs for insurance, and increased opportunities of approval for debt cards and home loans.

Additionally, credit repair can facilitate accessibility to essential services that need a credit history check, such as leasing a home or getting an energy solution. With a healthier credit rating account, people might experience increased self-confidence in their economic choices, enabling them to make larger acquisitions or investments that were previously unreachable.

Along with tangible economic benefits, credit scores repair work fosters a feeling of empowerment. Individuals take control of their monetary future by proactively managing their credit history, causing more informed options and better monetary proficiency. On the whole, the advantages of debt repair add to a much more steady financial landscape, inevitably advertising long-term financial growth and individual success.

Selecting a Credit Fixing Solution

Picking a credit report repair work solution needs cautious factor to consider to ensure that individuals obtain the support they need to improve their financial standing. Begin by looking into potential firms, concentrating on those with favorable client reviews and a proven track record of success. Transparency is key; a reputable solution ought to clearly outline their timelines, fees, and processes ahead of time.

Next, verify that the credit report fixing service adhere to the Credit report Repair Organizations Act (CROA) This government law secures consumers from misleading practices and collections guidelines for credit repair work services. Prevent business that make unrealistic promises, such as assuring a details rating increase or claiming they can eliminate all negative things from your report.

Furthermore, take into consideration the degree of client support supplied. A great credit report repair work service ought to offer customized aid, allowing you to ask inquiries and get timely updates on your progress. Look for services that use a comprehensive analysis of your debt report and develop a personalized technique tailored to your details scenario.

Inevitably, picking the appropriate credit rating repair work go to this web-site service can lead to considerable renovations in your credit history score, encouraging you to take control of your monetary future.

Verdict

In final thought, efficient credit report fixing techniques can dramatically enhance credit report by resolving typical concerns such as late payments and errors. A thorough understanding of credit history factors, incorporated with the involvement of trustworthy credit rating repair service services, promotes the negotiation of adverse products and ongoing progression surveillance. Ultimately, the effective renovation of credit rating not only brings about far better car loan terms but also cultivates higher economic opportunities and stability, highlighting the importance of positive credit scores management.

By attending to issues such as payment history and debt usage, people can take proactive actions towards boosting their credit history ratings.Lenders use credit score ratings to evaluate the threat connected with lending money or extending credit score.One more frequent issue is high credit rating application, defined as the ratio of current credit history card balances to complete offered credit history.Although credit rating repair can seem daunting, it is an organized procedure that individuals can take on to boost their credit history ratings and rectify errors on their credit report reports.Next, validate that the credit score fixing solution complies with the Credit rating Repair Work Organizations Act (CROA)

Report this page